Rimini Street: A Recession Hedge with Incredible Upside (Part 1)

Don’t Forget to Subscribe by Scrolling to the Bottom of this Article

Today, I am going to discuss one of the most interesting stocks I have looked at in a while. When I am investing, I try to identify multi-baggers that have a lot of potential and limited downside. My preferred way of investing is trying to find companies who have a lot of operating leverage they can capitalize on with a well invested management team. I think Rimini meets these all of these standards perfectly. It was originally going to be one part, but I didn’t take into account how much I like to write and so I am turning this into a 2-part analysis. This first part will be summarizing and analyzing the company as a whole while discussing the downside in the investment. The next part will discuss the upside, plans for the future, and valuation.

What do they do?

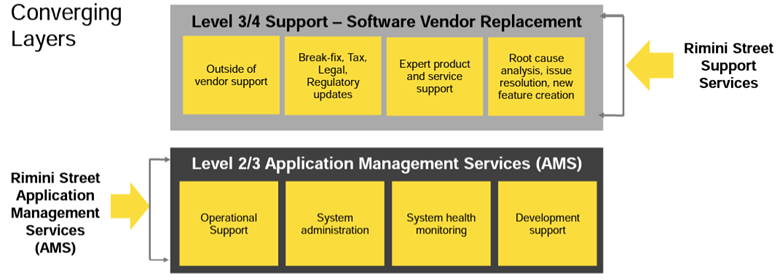

Rimini is a 3rd party IT service provider. The IT services originally offered were the most advanced level of maintenance services, which are 4th level services. They have, in the past few years, added 2nd and 3rd level services (will refer to this as AMS services). These lesser services increased the revenue per client, but it led to a poor marketing and sales campaign as the sales team didn’t know how to market these new services (more on this later). They do not offer level 1 services, which is basically just help desk services.

Rimini Support Services and AMS Services, from Rimini Q3 Earnings Report

Support Level breakdown, from Rimini Q3 Earnings Report

They offer long-term maintenance services for software such as Oracle, SAP, IBM D2, MYSQL, etc. They are also partnered with the salesforce ($CRM) and offer services for things such as SAAS.

Services Offered by Rimini Street, from Rimini Q3 earnings report

Since 2021, they have added services for security and consulting becoming the ultimate all in one IT service (and the only one).

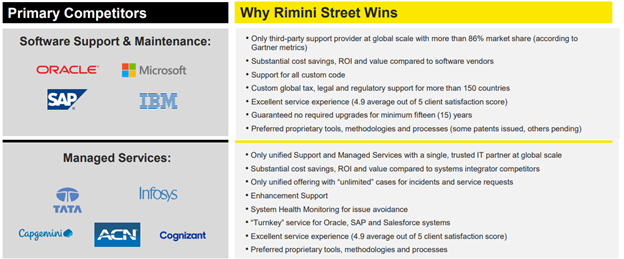

Competition

Their main competitors are the vendors (Oracle, SAP, IBM, Microsoft) themselves as Rimini owns nearly 90% of the 3rd party IT market. These vendors, for similar services to what Rimini offers, make margins up to 95% on their maintenance services. These margins create a real incentive for these vendors to keep these customers and do whatever they can to stop competition from pushing them out. This explains the Oracle lawsuit against Rimini that has lasted over 13 years. The courts have already determined that Rimini can operate as a 3rd party and not violate anything but that hasn’t stopped Oracle from continuing their lawsuits. This has had a long-term impact on Rimini, as roughly 4%-5% of revenue ($25m this last year) is dedicated to defending and appealing the lawsuits that Oracle throws at it. Primary competitors for their AMS services are TATA, Capgemini, Infosys, CAN, and cognizant. None of these competitors offer Level 2/3/4 support and this is where Rimini has built a huge edge (plus being very competitive in price).

Rimini’s primary competitors, from Rimini Q3 earnings report

They’re the Best and the Cheapest

So why does Oracle feel so threatened by Rimini? It’s because Rimini has created a monster value proposition that has grown with a CAGR in the double digits for the last 15 years. They have done this by hiring over 800 engineers, having the best in industry customer service, and charging roughly 50% of what competitors charge for arguably worse services. These three things define Rimini’s success thus far:

· Engineering Expertise: Rimini hires and trains engineers with an average of 15-20 years of experience. This allows customers to get answers to the hardest questions they face when it comes to long term maintenance. They have response times in under 10 minutes with most being close to 5 minutes. Overall, according to customers and my time scanning the web, Rimini is the best IT company when it comes to customer services and quality of service, most likely due to their experienced and efficient engineering team.

· Their customer service is considered the best in the industry with a satisfactory rating of 4.9/5. This has translated to a 94% retention rate. According to the CEO they have never lost a client due to dissatisfaction with the service. Their entire client base operates on a subscription model, making short term revenue relatively stable and predictable. The lock period for these subscriptions is 12 months.

· Rimini is the value deal in the industry, charging roughly 50% less for their services compared to SAP and Oracle. Even with this value proposition, they maintain a 60%-65% gross margin.

The total addressable market (TAM) is roughly $352B (currently Rimini has a SAM of $33.7B) for levels 2/3/4, security, and consulting. This leaves them with plenty of room to acquire market share (while still leaving plenty of room for oracle and sap, basically guaranteeing that margins will likely stay steady). This doesn’t include the growth experienced by the support services (level 4) market, which is roughly 10% CAGR expected for at least a decade, and 20%+ growth in the AMS market.

Market Share, Rimini Q4 earnings report

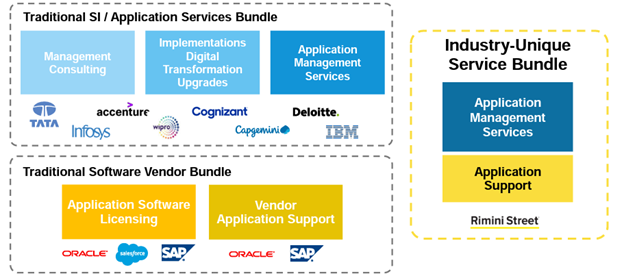

These services are bundled into one service so that Rimini addresses Level 2/3/4 for each of its clients for one price. This saves a lot of money for clients and increases the revenue per client for Rimini. No other competitor offers AMS combined with Level 4 offerings.

Competitive Bundle, Rimini Q3 earnings report

Committed Management and Shareholders

You’ll see this is a theme with a lot of my investments, I love companies with CEO commitment in the form of a large amount of stock ownership (other good options are appropriate compensation plans and signs of them actively buying a lot of stock). Rimini is no different with Founder and CEO, Seth Ravin, owning roughly 11% of the stock. This makes him the second biggest stockholder to Adam Street Partners, who own roughly 26% of the stock and have been invested since 2009. Ravin believes Adam Street is in it for the long run and this leads to roughly 40% of shares being owned by long-term holders.

The Opportunity

There have been a few things to cause an opportunity to form with Rimini. First and foremost, let’s get into a little history of the company. In 2017, Rimini became a public company through a SPAC deal. Unfortunately for Rimini, SPACs fell out of favor in 2018/2019 and contributed to a heavy sell-off of Rimini Street even though they were still a growing and profitable company. This led to a depressed price leading into the 2021 boom and as the price was accelerating in 2021, Rimini experienced its first slowdown in revenue growth leading to the stock getting killed after October 2021 (it halved in value in roughly 4 months) all the way until now where it trades at ~40% of the price that was traded in 2021.

Rimini Street performance, tradingview

Cheap Based on Current Growth and Recession Resistance

The current stock price has now created a ripe opportunity to invest in this company. Before we get into the upside potential, I think we should first discuss the downside risk.

Rimini is a fantastic bargain for basically the whole industry. They have the best service by a mile for the best price. This creates an opportunity during recessions, when the first thing that gets cut for most companies is SG&A. This means that IT departments across the country get a huge magnifying glass on them when there is a recession and companies are attempting to cut costs. This makes Rimini the go-to company when it comes to saving money on IT services, specifically on their level 4 services.

The other consideration is that Oracle and SAP tend not to provide services for extended periods of time (as they upgrade and try to sell better software). If a recession hits, customers are much less likely to want new upgrades in software as they try to cut costs. This is another way that benefits Rimini, as they provide services for extremely long periods of time compared to SAP and Oracle.

Rimini hasn’t experienced a recession while offering AMS services, and my understanding is they are not the cheapest option but the only option that offers level 4 services. This still leaves them with a competitive advantage compared to other its competitors while still being extremely competitive in price. When comparing AMS service companies, it also helps to bear in mind that Rimini offers the only all-inclusive subscription package, meaning they don’t charge on a per ticket basis as other companies do.

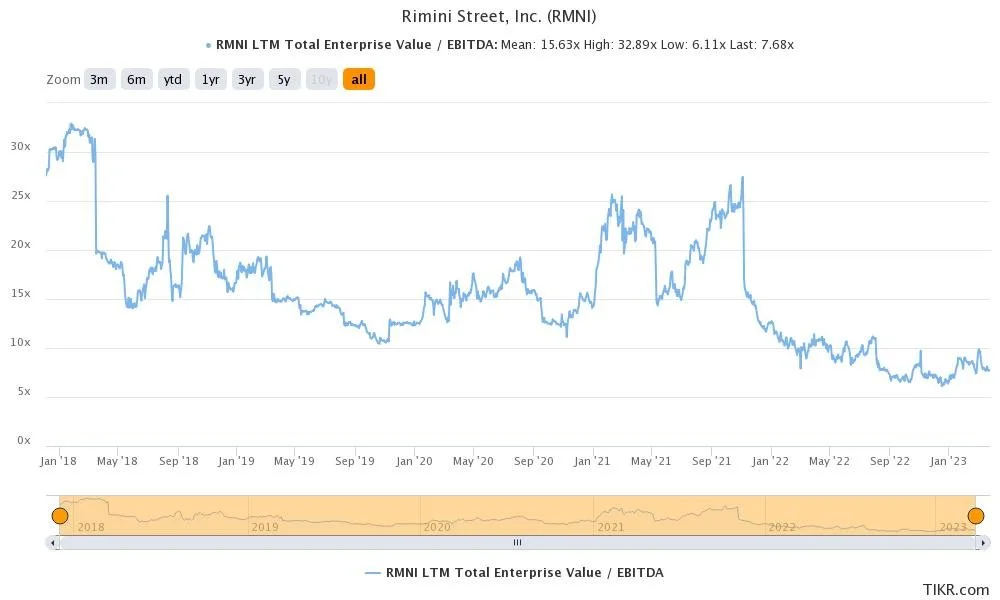

If we assume that Rimini can keep growing at their current pace, not accelerate growth, while maintaining their margins (which seems realistic based on the small amount of market they own and their ability to maintain margins while adding AMS service), they deserve a larger valuation. They are currently trading at 7.5x EV/EBITDA which is much lower than their historical >10x multiple.

Lifetime EV/EBITDA valuation for Rimini Street, Tikr.com

Their 7.5x EBITDA is assuming that Rimini will stop growing and this just doesn’t seem to be the case at all. In 2022 they grew revenue at 10%, which was lower than 2020 and 2021, but was the same amount as 2019. I think to assume they will stop growing based off a slowdown in revenue, from 16% y/y to 10% y/y, is inefficient pricing as they should still be valued at a 10x+ multiple with consistent positive free cash flow, which was growing until last year. Between the current low valuation assuming little to no growth and their recession resistance, this creates solid downside protection while providing some upside in a bearish scenario for the company.

In part 2, I will discuss the upside, future potential, and the valuation of the company.

Disclaimer: The author of this idea has a position in securities discussed at the time of posting and may trade in and out of this position without informing the reader.

Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment adviser capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC and CSA filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice. The author and funds the author advises may buy or sell shares without any further notice.

This article may contain certain opinions and “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. All such opinions and forward-looking statements are conditional and are subject to various factors, including, without limitation, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors, any or all of which could cause actual results to differ materially from projected results.