Rimini Street: A Recession Hedge with Incredible Upside (Part 2)

Don’t Forget to Subscribe by Scrolling to the Bottom of this Article

Here is the second part of Rimini Street Analysis. After discussing the operations and downside in my last article, I think it is now time to discuss the upside. I determined last week that downside was protected as the company is roughly 30% undervalued based on current growth, but if management can increase growth and expand margins then this stock has serious upside potential.

If you would like a PDF version of both parts combined, please email us (info@rogue-funds.com)

Upside Potential

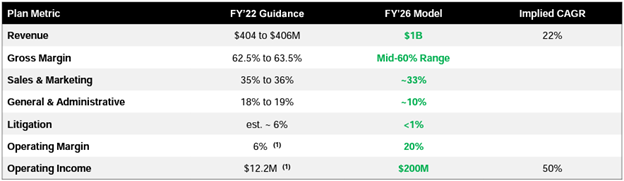

So first, what caused the slow growth in 2021? The miss in expectations can be attributed to an overly ambitious plan that led to a massive expansion of the sales team, which floundered, and growth stagnated then add additional G&A costs due to the offering those extra services and you get even more margin compression. To understand what I mean regarding overambitious growth, see this 2026 goal chart from Rimini's Q3 2022 presentation.

2022 Guidance and 2026 guidance from Q3 2022 Investor Presentation

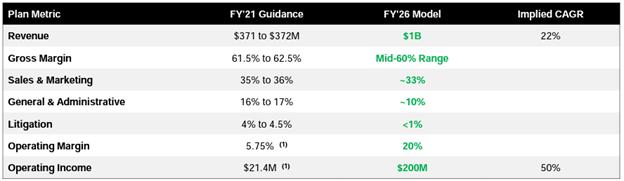

Their 2026 goals were set in 2021, and clearly the market isn’t buying it. The improvements since 2021 can be seen by comparing the above and below charts (below chart is the guidance from 2021):

2021 Guidance and 2026 Guidance from Q3 2021 Investor Presentation

This led to a slightly embarrassing (but appropriate) change in goals from management where they pushed their goal posts further out, which is much more realistic in my opinion. Their goal is still to hit $1B in revenue but now it is in 2028. These new guidance changes can be found in the chart below:

2023 guidance with updates to 2028 model from Q4 2022 Investor Presentation.

I would like to clarify that this company has only been public for five years. Overshooting is something that commonly occurs in-house but when it comes to speaking to investors, this can quickly spook investors (as it has with Rimini), as it seems they can no longer trust management. I blame this overshot on a CEO not used to dealing with public markets, and don’t think we’ll see any more over the top goals especially based on the CEOs’ comments on the last earnings call (margin expansion does seem a little aggressive still). The current mindset of management is to keep it more conservative and just work on beating small goals (psychology has proven small goal setting to be a better management style anyways). I believe the 2028 goals are completely realistic (with a slightly aggressive operating margin expectation) and I will explain why below:

Revenue

First, increasing revenue by 10% y/y is way behind their new goal of 16% CAGR. According to Ravin it takes about 12-18 months (with a concerted effort towards getting this below a year) to train new sales members on their whole list of offerings. Due to their overly ambitious plans, they rapidly expanded their sales force going into Q3 2021 (to hit their revenue goal) and this had catastrophic results as the sales team became much less efficient in selling/understanding Rimini’s whole list of recently added products. We should be closing in on a more experienced sales team, which is reflected in the recent earnings calls. My understanding of the current situation is that as the sales team has become less of a problem, it has become more of a marketing problem than a sales problem.

So how is Rimini addressing the marketing problem? Rimini ONE.

Rimini One from riministreet.com

Rimini One was announced a few days ago and is the new marketing strategy for Rimini. It basically combines all their different services into one easy to use, unified service. They believe that pushing all these services as one service will be much easier to market. I cannot confirm that this will work, as I can’t see the future, but from their early testing on clients they saw good results. If anything, it shows that management is constantly working to improve the different challenges that they face.

I truly believe we will be turning the corner on revenue growth this year to get it up to the 16% mark. Management made it very clear that current revenue guidance for 2023 is conservative and they want to get in a habit of raising and beating.

Gross Margin

Since adding on their AMS services, they have not had any drop off in Gross Margins which encourages me that this will continue for the foreseeable future, and it doesn’t seem to be a big reach to assume that these margins will stay consistent in the low-mid 60s.

Sales and Marketing

Probably their second most important focus after their customer service/engineering, is their ability to sell and market the product. This most likely won’t lessen over time and I think assuming 33% of revenue isn’t necessarily wrong but I think we should stay conservative at the current amount.

G&A

General and Administration is where management expects to see their biggest gains in operating margin. This is where the business model begins to work its magic in my opinion. As a decentralized business model where they operate mainly remote this allows them to keep G&A costs down as revenue expands. This is huge for the operating leverage they expect, and I suspect that the reduction in G&A to 10% as a percentage of revenue (by 2028) is very close to reality.

Litigation

As has been discussed earlier in the article, litigation is a huge issue that Rimini has faced from Oracle. Even if we assume that the litigation will continue (which I believe is coming to an end soonish), it will begin taking up less and less of the operating margin, allowing Rimini to see much better operating margins. This means that litigation will shrink over time. If Revenue doubles to $800m then more than likely we will see the litigation costs drop to below 3% (and most likely lower).

Cash Allocation and Balance Sheet

This is the first true concern I have with the company. They have been compiling a very large cash pile (roughly 1/3 of the market cap) and do not seem to have much of a plan for addressing this large amount of cash. They have recently bought back $5m worth of stock and continue to pay down their term loan but we have yet to see any real use of the excess cash. When prodding IR, they didn’t give much of an answer on how they plan to spend the cash in the future. The balance sheet is in great shape even with high current liability which is simply due to their subscription model causing high unearned revenue. Overall, it’s a concern that most companies would love to have but I am curious what they plan to do with the excess cash in the future and it’s something to watch for.

Valuation

Considering the expectations of the future for Rimini Street, their excellent balance sheet, and their recession resistance, I find their current valuation to be extremely low. If we take them at their word for 16% revenue growth (which I believe will be feasible) and make conservative adjustments to their operating margin goal of 20%. I believe a true operating margin closer to 15% will be much more conservative and it gives us an operating income of around $150m in 5 years (FCF comes in a little higher due to the retained earnings from the subscription model and maintenance Capex around $4m-$6m). This is massive operating leverage from their current $28.5m in operating income. With merely a doubling in sales they would increase their operating income by a multiple of 5x (and a huge increase in earnings since litigation currently eats a lot of the operating income away). This gives us a conservative valuation of around $1B assuming stagnant growth after they hit $150m in FCF (which is extremely unlikely). This is a per share value of roughly $11.50/s, which I believe to be a conservative estimate. This is more than 3x the current enterprise value and nearly 3x the market cap.

Conclusion

Rimini Street offers a ton of downside protection with the market mispricing this security as a shrinking company with little upside potential. I think the market has completely missed the idea and has even missed the fact that now Rimini is beginning to grow its other services which are beginning to show the strength of their new and broader model. Rimini offers a ton of upside potential with limited downside risk due to their recession resistance and great management. We know that the CEO is extremely committed to this, as he owns over 12% of the company (although he does sell from time to time). I think Rimini Street’s all-inclusive value model will reward investors who are willing to ignore recent pitfalls and hop into a company that is building and growing its free cash flow.

Disclaimer: The author of this idea has a position in securities discussed at the time of posting and may trade in and out of this position without informing the reader.

Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment adviser capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC and CSA filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice. The author and funds the author advises may buy or sell shares without any further notice.

This article may contain certain opinions and “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. All such opinions and forward-looking statements are conditional and are subject to various factors, including, without limitation, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors, any or all of which could cause actual results to differ materially from projected results.