Macro Perspective: Why I am Worried

Don’t Forget to Subscribe by Scrolling to the Bottom of this Article

Sorry for my extended break from blogging, I have had some major life changes recently such as moving this past month. Additionally, I have started my first month of accepting outside investor capital, leading to the official kick off for Rogue Funds, LLC. Jumping any hurdles and creating a smooth transition for my initial investors has been my majority focus. I wrote my first letter to investors last month and will not be posting on the blog until most initial investors are integrated into the fund. If you are interested in the first letter to investors, please fill out the contact form. Focusing full time on research and integrating investors has been my main focus but as things settle down I will get back to blogging on a semi consistent schedule.

Macro Breakdown and Why I am Worried

At Rogue Funds, we very rarely trade macroeconomic trends but it is something we are constantly paying attention to so we can get our capital the hell out of the way of extreme risks. The point of this article is clarify our macroeconomic framework and what we are avoiding (and other macro econoic opinions).

Recession is coming

We’re well on our way to a recession as inflation continues to maintain much stronger levels than the Fed would like. Inflationary strength will induce the Fed to bring the hammer down (slowly of course) on the economy until everything normalizes. The beginning stages of the recession have begun to accelerate in the past 6 weeks and we will begin to see this acceleration increase through the rest of the year and into 2024.

Inflation is still maintaining

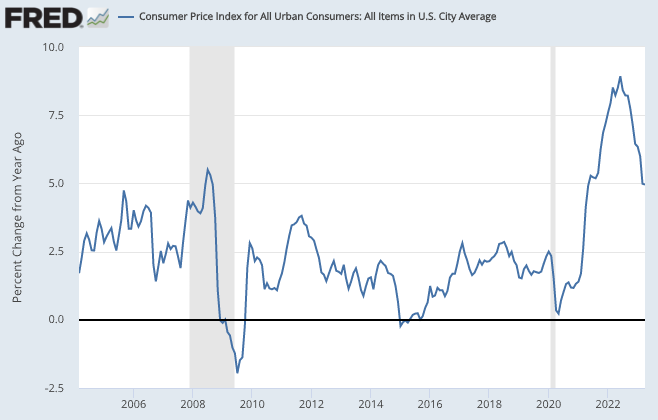

In April 2021, the United States experienced its first 4% rise in inflation in over a decade. Since then we have seen inflation as high as 8.9% and 2 years later we are still well above the Feds self mandated goal of 2%. Of course wages have grown at an extremely rapid pace in the past 2 years and will continue to drive inflation forward. The behavior of inflation to be stickier than expected at this 4%-5% level is very similar to the thesis I laid out on various platforms in November of last year (didn’t have the blog yet but you can view my article on sum zero here, I said I was bearish bonds but the main point was to show my future macro predictions of things, which has shown to be a very accurate representation of things today) when I predicted a slowdown in the decline in inflation due to various sticky issues.

CPI y/y growth provided by FRED

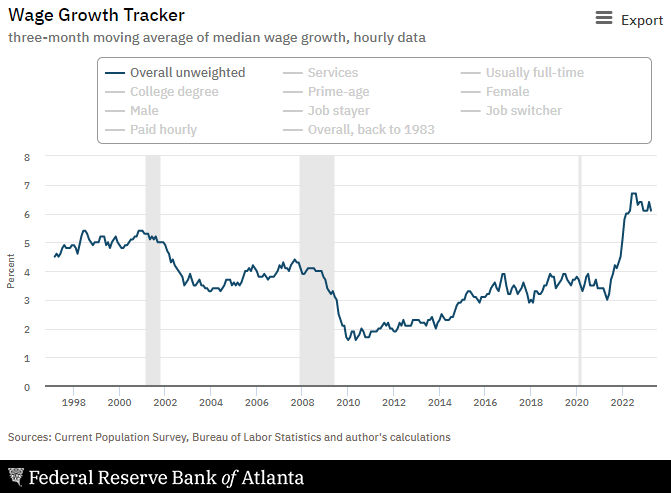

There are many drivers for an inflation decline to stagnate and wage growth is one of them. Wage growth began to accelerate immediately following the increase of inflation in early 2021 and has since grown at a rate not seen since the 1970s. Again, as I explained almost 7 months ago, wage growth is a much stickier issue and is underdiscussed in the public (although the issues with it are obvious). Wage growth has basically maintained at 6%+ and this is a massive issue for the Fed and is something I warned would be much harder to break than the Fed believed a year ago. It’s just another driver for my expectations that we will see numerous more 25 bp hikes from the Fed until something huge breaks.

Wage Growth has stagnated

What’s Breaking and what’s the Impact (in the United States)?

Basically anything with any affiliation to rates is beginning the slow downward trot towards Armageddon. Obviously we saw regional banks collapsing because banks forgot to hedge their duration risk (short term profit can have that effect). Outside of that I see risks across the economy and I believe prices in these areas will begin to have an effect on economic growth (as well as equities). Of course this won’t affect the inflation number that CPI will produce (at least not initially, you have got to love a lagging indicator), which will lead the Fed to continue hiking, spurring on the odds of a recession.

Housing

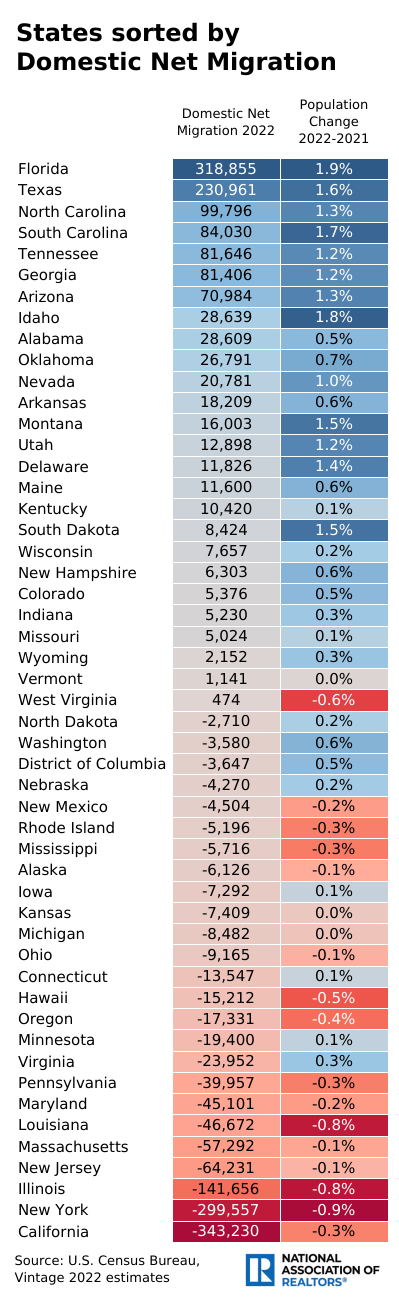

Housing is obviously a risk, especially in areas like California and New York where unpopular economic and social policies are sending individuals out in droves, which has been combined with a multi decade bubble in housing prices in those areas. The policies being provided by these states show no signs of abating, so, I imagine until a recession hits these areas, there will be very little political change and I expect these trends to continue. These areas, which have experienced unprecedented housing influxes are now experiencing unprecedented emigration. The clear beneficiaries are basically all southern states and other rural states such as Montana, Idaho, Utah, etc. I cannot predict how housing will be effected in these beneficiary states but it is blatant that there will be a shift in wealth from predominately high population density states to more rural states (this will most likely have electoral consequences over the coming decades, if trends maintain, and should be something to watch). Suburban areas will most likely benefit from this trend as well.

Net Migration Chart by State. Implies exodus from large California cities, NYC, and Chicago

The consequences of this will be huge for California and New York (there are other effects of this emigration that I will discuss later). Housing supply is already increasing across the country but predicting long term home pricing is tricky due to its inherent demand. The issue for California and New York, is that demand is dumping at unprecedented levels while supply begins to rapidly grow. If you catalyze this with the near bubble level of pricing that California and NYC has experienced recently, they are going to be in for a rude awakening.

Outside of the heavily hit areas of NY and California, I think we will definitely see some decline in housing prices across the country but it is extremely hard to predict how much or how extreme it will get (especially not as a one size fits all). This will again weigh on the wealth effect for most consumers.

Commercial Real Estate (CRE)

Commercial Real Estate (CRE) at this point is the single biggest risk to the banking sector and I wouldn’t say it’s particularly close. The “work from home” trend has hardly moved a muscle since COVID ended, which is helping contribute to the mass exodus from places like California and New York where the economic consequences from living there are much greater when you can get paid to work from anywhere. This has created an unprecedented amount of “zombie” office buildings in places like NYC, Chicago, SF, LA, and other low growth large cities in the United States. The Boston Consulting Group, did an amazing breakdown of this phenomenon at the following link: https://www.bcg.com/publications/2023/countering-the-surge-of-zombie-buildings .

Imagine a progression as follows:

Less employees in office leads to less demand in city areas.

Businesses then lay off employees (due to less demand) and sell their businesses adding to the supply of buildings in the city for sale.

Unemployment ticks up due to business closings, consumer demand lowers again.

Eventually nonretail companies sell their buildings as their bottom lines lower due to less inherent demand.

The inherent cyclicality being impacted by rates plus there being no buyers, due to the trends above, leads to a write down on their balance sheet which leads to more cash being needed.

Some companies will begin to default on their CRE loans leading to lower prices as they are forced to sell.

So on and so on.

As you can see this is a very rough idea of the downward spiral that will occur in the commercial real estate market.

The secondary effects of a decline in CRE prices will begin to affect banks who gave commercial loans to these businesses in the form of commercial mortgage backed securities (CMBS’s). This is setting up a similar scenario as MBS’s in 2008 and I believe risk on these will increase immensely, obviously the fraud isn’t as intense but valuation risk is still there. The at risk parties of these CMBS’s are regional banks (Biggest 5 banks have 70% of CMBS’s but much more diverse set of loans “reduces” their risk a little bit, risk is definitely there if default cycle is extremely severe), so it would be a cause for concern for regional banks that have large amounts of exposure to CMBS’s specifically in the cities I listed above. Regional Banks will be one of the first cracks in the system when CRE starts coming down (and remember the Fed will most likely be very late on this as it doesn’t directly affect consumers when it comes to CPI), especially with the exposure of CRE to Floating Rates (comerica?). The devaluation is already beginning across CRE, but it hasn’t affected balance sheets yet as we are in the beginning rounds:

The other issue that is not being discussed as much and which is deemed to be relatively safe are Collatoralized Loan Obligations (CLOs). CLO’s began to enter the insurance arena as ultra low interest rates had insurance companies searching for any type of extra return they could find, beginning around 2018. Since then an extremely large amount of insurance companies bought these “investment grade” CLO’s to juice returns as COVID kept interest rates at all time lows (inflation also most likely spurred a push for more returns). Here is a review from 2020 and the situation has accelerated since then as risks have increased:

https://www.insurancejournal.com/news/national/2020/07/31/577501.htm

The issue with CLOs (similar to CDOs in 2008) is that once commercial real estate suffers, all sorts of commercial lending suffers. This comes as default rates lead to tightening in the debt and equity markets leading to wealth effects across all consumers. This type of risk could expose the insurance companies to these extremely risky situations that could cause contagion across the financial spectrum. Most “stress” tests seem to be arbitrary and I believe this could pose true risk to the insurance industry in the case of an extreme default cycle. I am making absolutely no bets on this but I am definitely aware of the risks.

Natural Gas Presents Increased Inflation Risk on a Global Scale

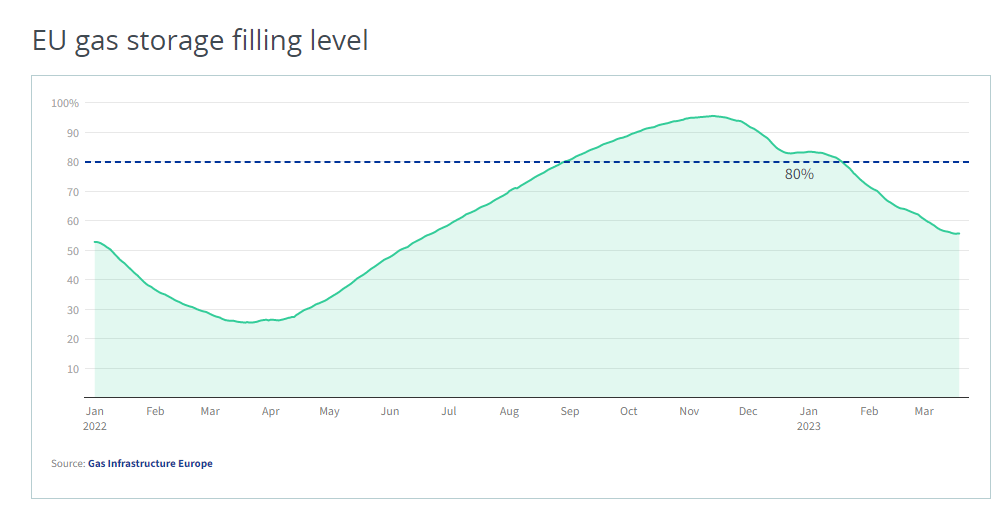

The natural gas crisis in Europe is entering the exact same situation this winter that it experienced in 2022. Outside of temporary floating LNG facilities in Germany (total import capacity after LNG facilities is expected to be 37 bcm/year in 2024, total storage around 25 bcm and with total consumption being about 96 bcm/year… I’ll let you do the math on how much they need from the European gas infrastructure), the EU has punished anyone who would try to increase the natural gas infrastucture in Europe by slamming O&G companies with a massive windfall tax that has left many projects abandoned on the continent. This also doesn’t include ignorant environment policies such as Germany shutting down their remaining Nuclear reactors (not sure how this helps the environment but that’s the claim). To say that Europe has pushed incompetent energy policy is simply an understatement.

EU Storage levels are much higher than April 2022 due to warm winter

To be completely frank, Europe got extremely lucky last year as they experienced one of their warmest winters ever, and the odds of them escaping with that luck the next 2 years is extremely low. With the additional demand from East Asia coming in I would expect energy prices (whether thats coal, nuclear, or natural gas) to remain elevated over the next 2 years until European governments gain the intelligence to invest in their infrastructure. Poor European policy will pull natural gas from both the US and Japan (also from China, but they will most likely switch to coal). This will most likely end up in inflationary pressure on all of the involved parties, leading to increased monetary contraction from central banks as poor fiscal policy is fought with tight monetary policy. This battle will most likely result in recession whether it’s from the sustained inflation in the UK (10%+ inflation), Europe (8.5%+ inflation), or the US (4.5%+ inflation), or if it’s from the recession from tighter monetary policy. With higher interest rates, inflation, or extremely poor fiscal budgets, it is hard to see a scenario where a bailout on the equivalent of 2008 (adjusted for inflation) is in the cards.

Other Macro Thoughts

The three other macro impacts to pay attention to is global fiscal policy, student loans, and AI. I won’t go into detail on either but the horrible budgets of most western countries and their tendency to overspend which has only accelerated since COVID is something that has to be acknowledged. These horrible fiscal policies will most likely come to a head this decade in the form of spending cuts, higher taxes, defaults, or inflationary episodes. It will be extremely hard for countries to keep bailing out their economies and markets are beginning to pay attention (looking at you New Zealand).

AI could introduce heavy growth potential across the world, but the level of impact will be interesting to see. I am not optimistic in its ability to completely change the world in its current state. AI could lay waste to many white collar jobs in a trend we have already begun to notice before AI began to exponentially expand a few months ago. If things go extremely well it could help alleviate pressure of both inflation and budget constraints. Either way I do not think it is significant (yet) but the innovation in the AI open community has simply been incredible to where Googles CEO came out and said that no business can compete with the rapid innovation of the public community. It is something all investors need to pay attention to.

Student Loans will, most likely, introduce consumer spending contraction later this year. Of course, it could be delayed again but I find this to be unlikely as government bills begin to grow. The supreme court will almost guaranteed shoot down student loan forgiveness taking that completely off the table, but it was realistically never on the table to begin with (it’s just political grandstanding). The direct impact on 20-40 year old’s, whose personal savings rate is nearing lows and who also happens to be a huge spender for discretionary goods, will most likely lead to some sort of economic contraction. The significance can only be guessed.

Where I Stand

All of these trends could take much longer than the timeframes I laid out in the article, the economy doesn’t go to zero in a second. Negative housing trends began in 2005 and impacts weren’t felt until late 2007, the internet bubble burst took nearly 3 years for it to finally bottom out, inflation began in 1967 and didn’t truly cause massive economic problems until 1973. I cannot predict the future and I don’t trade like I can. I am simply aware of extreme economic headwinds and I plan on getting the hell out of the way. The current portfolio is built for providing some recession resistance and we have increased our special situations allocation to accommodate for this. Simply being informed of everything can be extremely helpful in navigating what is one of the craziest macro environments in 15+ years.

Disclaimer: The author of this article has no position in securities discussed at the time of posting and has no plans of trading in or out of any securities discussed over the next 48 hours.

Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment adviser capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC and CSA filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice. The author and funds the author advises may buy or sell shares without any further notice.

This article may contain certain opinions and “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. All such opinions and forward-looking statements are conditional and are subject to various factors, including, without limitation, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors, any or all of which could cause actual results to differ materially from projected results.