Sezzle, Inc: Buy Now Pay Later Turns Profitable

Don’t Forget to Subscribe

Note

Sezzle currently trades on the ASX (Australian Securities Exchange) but all numbers and charts in this article are expressed in USD (United States Dollar) unless expressed otherwise.

Brief History on Buy Now Pay Later (BNPL)

The BNPL phenomenon began in the 2010s and took off in 2020 due to the massive boom in internet shopping. Massive valuation bubbles came, and massive valuation crush followed. Most of the industry is filled with companies that burn cash by the millions and sometimes billions. Most of these companies survived merely on their lofty valuations (some of them still have lofty valuations even with intense sell offs) as they sold stock and offered massive stock-based compensation.

Of course, many investors might know Sezzle for their part in the tech bubble that occurred in 2020 and 2021. As you can see in the chart below, they have experienced a large fall from grace since the peak tech bubble.

Sezzle Chart from TradingView

Going from $325/s to $13.31/s is quite the fall off and I believe it is pertinent to the current turnaround occurring within the company. Unlike my previous posts, I think it is pertinent to start this analysis by understanding the motivation for management to turn this ship around.

Huge Management Interest

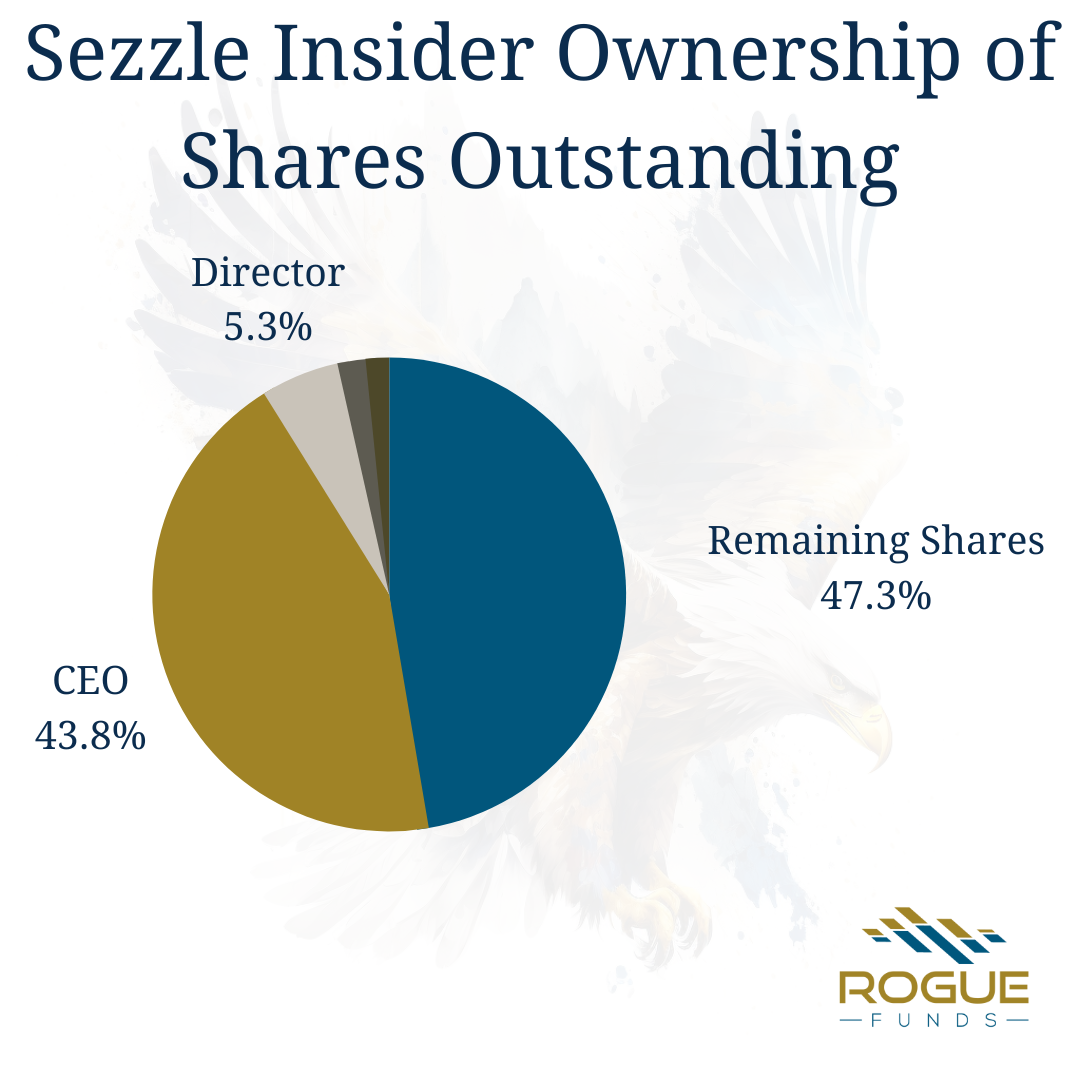

The CEO and Executive Chairman, Charlie Youakim, has massive interest in the company. He holds over 43% of shares, valued at $32.5m dollars. My estimations are that the CEO has lost over $500m in unrealized gains from the bubble collapse. Other executives combine for more than 7% of the stock. This means 50% of the company is owned by insiders, having lost over half a billion in unrealized gains and I believe this sets up the story for the investment. Management incentive could not be higher for Sezzle to both survive and thrive. I believe this is what has helped drive the current turnaround story for the company to a more profitable and sustainable model.

Survival and Drive towards Profitability

The problems with Sezzle’s cash burn became apparent as the stock price began to crumble and they began to seek out a bailout option in the form of an acquisition. Their knight in shining armor was to be another industry player, Zip. Zip was also in a heavy cash burn state and could not come up with the funds to afford the transaction and by July 2022 the deal fell apart. This led to analysts having an expectation that Sezzle was on a straight path to bankruptcy (given an average price target of $0.01 AUD).

With their lifeline cut off, Youakim went to work cutting costs on for the company in order to keep the company afloat (while also targeting quick revenue initiatives). The actions he made in 2022 can be seen in the list below:

Laid off 20% of N.A. Workforce (Saving ~$10m).

Reworked Supplier contracts.

Unprofitable merchants were either renegotiated or cut off. (Went from 47k merchants to 42k merchants)

Exited Operations in Brazil, Europe, and India.

Launched Sezzle Premium.

Incentivized consumers to use lower cost ACH for repayments.

Since the company took drastic action to reduce expenses, the company has seen a huge boost in profitability, as can be seen in the chart below.

As SG&A expenses are now under control and profitability is becoming more consistent, I believe that the tides are beginning to change for Sezzle. With their balance sheet in great shape and consistent profitability within grasp, Sezzle is allowing itself a long runway to sustainable profitability and growth.

Differentiating from Competition

As the sole focus of the company had been to survive for the past 12+ months, this led to profitability becoming the number one goal. This temporarily caused a pullback in revenue as merchants were dropped and others were not willing to reprice. In the last 3 quarters, the trend towards increasing revenues has begun again, except this time it is followed by sustainable profitability. The reason for the reacceleration in the top line is due to a focus on the consumers that BNPL appeals to, along with a strong drive to focus on separating Sezzle from the vast number of competitors and creating a moat to keep customers.

How Sezzle Differentiates Itself

Sezzle charges no fee to customers themselves and allows users to pick a payment plan that lasts no more than 6 weeks (the initial payment must be at least 25%). This allows customers to spread the cost of items on a multi-week basis. This takes on much less risk than a credit card or longer-term lender such as Klarna or Affirm. Their main source of revenue is from charging merchants’ fees for offering their BNPL service on their site.

In mid to late 2022, Sezzle introduced two initiatives to drive revenue and reach their younger demographic. The first initiative that was introduced was Sezzle Premium, which is now bringing in $11m in revenue and 155k subscribers.

The second initiative that helped drive revenue and was introduced in late 2022 was Sezzle Up. This initiative specifically targets the younger audience that Sezzle attracts by allowing them to build credit.

From 2022 Sezzle Annual Report

Sezzle Up allows consumers to build their credit by using BNPL and reporting consumer payments to credit bureaus, hence allowing younger generations (who notoriously don’t use credit cards as much) to begin building a credit history. This upgrade is completely free but encourages spenders to keep utilizing Sezzle to build their credit history.

New Initiatives

In 2023, I believe we will start seeing large increases in revenue from new initiatives, which management believes will lead to a $10m increase in earnings (management in the past year has vastly outperformed their income expectations when it comes to their different initiatives).

The first huge hitter being introduced is their “pay in 2” option, which is meant for grocery shopping or monthly bills. I believe customers will love paying for their monthly expenditure on a “pay period” (every other week) basis and I think this will drive more spending through Sezzle (should help that they have partnerships with certain large retailers such as Target).

The second (and much bigger deal) is their Sezzle Anywhere initiative. This initiative will be a subscription model that is going to be more expensive than their Sezzle Premium option, but it will allow users to pay anywhere using Sezzle and then spread out their payments. The below graphic describes the difference between Sezzle Premium vs Sezzle Anywhere. The Sezzle virtual card can be used anywhere visa is accepted and can be utilized through Apple Pay and Google Pay. Initial, unmarketed, beta testing of Sezzle Anywhere has shown a strong connection with consumers and I think this will be a huge advantage Sezzle, while also offering a great way to build brand recognition.

From sezzle.com

They have also reported that they plan on possibly partnering with a bank for future initiatives. We should hear more on this initiative in the Q2 or Q3 calls.

Competition is Fierce

A huge uphill battle is the massive amount of competition that Sezzle faces. I will go through that in this section while also comparing how competitors stack up against Sezzle. It should be noted that Sezzle is the only pure BNPL company that is operating at a profit and makes most of their revenue in North America.

Credit Cards – Credit Cards are an indirect competitor to Sezzle and will continue to be so. I think Sezzle holds a strong advantage over younger consumers. Some credit card companies such as Chase do offer pay overtime options, but these seem to be underutilized and usually require some sort of subscription.

PayPal – PayPal has recently offered a BNPL option, and it will hold a strong competitive advantage over any website that uses paypal for transactions.

Apple Pay Later – Apple Pay Later was launched recently and is very similar to Sezzle Anywhere. The only difference is it’s only for payments of $50-$1000 dollars and requires credit score approval (Sezzle avoids this). Apple Pay Later is only available online whereas Sezzle anywhere can be used anywhere. Of course, anything integrated with Apple is a threat, but Apple does not offer the same services that Sezzle premium offers. Sezzle seems to be offering a more premium version of Apple Pay Later, and arguably easier usage. Again, Apple’s name alone makes them a serious competitor.

BNPL Competitors (Broken Down by Company)

Affirm: Affirm tends to operate using an interest rate and longer payments (not quite the same wheelhouse as Sezzle). They have been cash burning heavily for a long time and will have to make drastic changes soon.

Klarna: Takes parts of both Sezzle and Affirm. I believe Klarna will most likely be the biggest long-term threat to Sezzle, but due to their longer-term payment plans I think they will experience a lot of the same losses that Affirm is dealing with. They have a strong competitive advantage in Europe that Sezzle most likely won’t be able to overcome (at least in the near future).

Afterpay (Owned by Block): Probably the most similar competitor to Sezzle, they are found in a lot of the same areas and it’s hard to know how good after pay is performing, due to Block acquiring them in 2022 (by massively overpaying). Block itself is not performing great, and they don’t report on Afterpay individually because Block management claims it is part of both Square and Cashapp. I think overtime the lack of focus on the product itself will give Sezzle an advantage over Afterpay (plus the Block management has a historical tendency of not monetizing things well)

Zip: Zip is nearing bankruptcy and will most likely be filing within the next year or 2 as they have begun to pour debt into the company. Zip is still a very similar competitor but has not been able to find a route towards profitability like Sezzle has and I think its lifespan will be very short from here.

Splitit: A very strong influence in Asian nations. They are still in a cash burn operation but have about enough cash to last the year so I expect them to begin taking out more debt to fund their operations. Their Asian positioning is one of the best in the industry.

Financials are Set-up for Success

First and foremost, when it comes to financial stability, Sezzle has one of the best balance sheets in the whole industry (if not the best balance sheet in the industry). The company has a brilliant current ratio, and basically zero net debt. Their shares outstanding have been relatively flat over the past few years, and I expect this to continue (less than 10% increase in total shares over the past 3 years). Overall, there is not much more you can ask for from a balance sheet standpoint, which is great to see right as the company becomes profitable.

Free Cash Flow (FCF) is Imminent

Sezzle seemed to be showing signs of getting near positive FCF, but in the most recent quarter they had a Free Cash Flow loss of ~$4m, closer to $6m when accounting for Stock Based Compensation (SBC).

I believe this will turn around quickly as most of this came from their accounts payable getting hit due to an increase in interest rates. Sezzle can hold onto accounts payable if they pay a certain amount of interest to merchants but as interest rates increased it was no longer favorable for these merchants to let Sezzle hold onto their accounts payable causing cash to quickly be pulled from Sezzle.

This should be corrected as Sezzle has recently bumped up their rates on their accounts payable to 5%+, which they believe should stabilize accounts payable and will most likely allow it to build back up again. I think this will lead to a short-term boost to FCF from working capital changes over the coming quarters. If you also account for net income increases, I think we will see consistent positive free cash flow in the coming quarters.

Valuation

Based on Sezzles future growth and current profitability/FCF normalization, I think it will be safe to say that Sezzle is a very short time frame away from trading around 7x EV/EBITDA which I believe is undervalued based on their growth runway and newfound profitability. I think by late 2023 we could see Sezzle producing $10m+ in FCF (not including SBC) based off of new initiatives and a focus on both top and bottom-line growth. I think a valuation of close to $140m today (14x EV/EBITDA, $40/s AUD) would be appropriate compared with a market valuation of $78m. If Sezzle keeps firing on all cylinders and strong growth reaccelerates this could easily be worth $200m-$300m. I think at current prices, the downside is protected as bankruptcy seems to be off the table and there is a ton of upside potential due to growing profitability.

NASDAQ Listing

Sezzle is set to be listed on NASDAQ which is obviously a much bigger exchange than ASX. Sezzle has been working on becoming a NASDAQ listed company since January of this year and just completed a 38-1 reverse stock split to fit the NASDAQ minimum price requirement. The company expects to get listed in the next few months right as profitability and FCF come to fruition. I believe this could be a strong catalyst as upward fundamental pressure combines with the NASDAQ listing.

If you would like a PDF version, please email us (info@rogue-funds.com)

Disclaimer: The author of this idea has a position in securities discussed at the time of posting and may trade in and out of this position without informing the reader.

Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment adviser capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC and CSA filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice. The author and funds the author advises may buy or sell shares without any further notice.

This article may contain certain opinions and “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. All such opinions and forward-looking statements are conditional and are subject to various factors, including, without limitation, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors, any or all of which could cause actual results to differ materially from projected results.